Unfolding in the field in France over the past fortnight would – alone – have warranted half a dozen “client alerts”: an official inquiry into the PNF by the Justice ministry, a shining new Justice Minister who – at best –thinks very little of the PNF and wants to cut short “preliminary” investigations, Judges’ union call the appointment of the Justice Minister by President Macron a “declaration of war”, spying by the PNF on several law firms to determine who may have stopped by, yesterday’s 2019 activity report by the French Anticorruption Agency, etc.

We’ve put some thinking into the following (and much more): are internal investigations still an oddity in the legal community?, Double jeopardy in tax & criminal matters catch 22?, European Public Prosecutor a landmark gone unnoticed?, What is the CJIP going to be extended to next?

Uncertain waters lie ahead, more than ever we are confident that the legal community, our friends here in Europe and around the world, are the cornerstone of “le monde d’après”. Stay safe & in touch!

Special thanks to Laurine Becker, Alice Béral, Princessa Fouda, Sarah Reilly, Clément Allais, Sara Deyhim, Amelle Djedi, Soukaina El-Mekkaoui, Alex Kodiane, Christelle Meda, Ekaterina Oleinikova & Julia Velho.

Best wishes

***

Index

Legislative, Regulatory & Policy Updates

- French criminal procedure welcomes the European Public Prosecutor, Read analysis

- Paris Bar Council releases a Report and updates the Guidelines on the role of lawyers in internal investigations, Read analysis

- An environmental CJIP towards a greener transaction justice, Read analysis

- French Ministry of Justice reacts to the European recommendations for fighting international corruption, Read analysis

- The GRECO Fifth Evaluation Round report on France, Read analysis

- Some recent developments in criminal law in France amidst the Coronavirus pandemic, Read analysis

- Is there room for improvement in the French law on whistleblowers in the wake of the transposition of the European Directive of October 23, 2019 on whistleblowers protection?, Read analysis

- Incompatibility of French asset freeze measures with EU law, Read analysis

- France finalizes the transposition of the 5th Anti-Money Laundering Directive by adopting new provisions on the fight against money laundering and terrorist financing, Read analysis

- The French Anti-Corruption Agency releases updated guidelines on the corporate anti-corruption compliance function, Read analysis

- A major role for the AFA in the Anti-Corruption Authorities’ global mapping?, Read analysis

- The French Data Protection Authority releases guidelines on professional reports, Read analysis

Enforcement & Court Decisions

- Ne bis in idem: France stays on the sidelines of the European stance on the cumulation of criminal and fiscal sanctions after last decisions rendered by the French Supreme Court, Read analysis

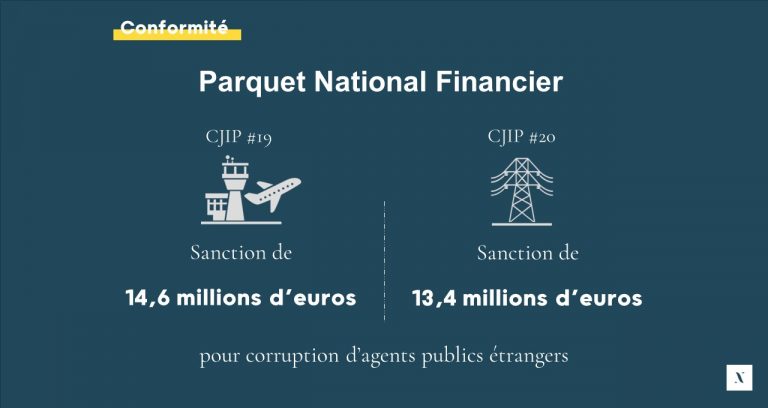

- Key takeaways from the past year’s CJIPs, Read analysis

- French Supreme court ruled that the non-compliance with anticorruption provisions could enable co-contractor to terminate established business relations, Read analysis

- Lesson drawn from the two first decisions of the Enforcement Committee of the French Anti-corruption Agency, Read analysis

- The French Supreme Court confirms its position on the presumption of money laundering, Read analysis

- French Court approves dismissal of an employee for breach of company anticorruption policy, Read analysis

- The French administrative Supreme Court recalls the limits of the employer‘s internal investigation powers vis-à-vis employees, Read analysis

3-lines outline of some noteworthy events

- French Prosecutors continue to conclude French Deferred Prosecution Agreements, Read analysis

- The French Anti-Corruption Authority releases its 2019 activity report, Read analysis

- New article 314-1-1 of the Criminal Code introduces the offence of breach of trust for violations of the EU’s financial interests, Read analysis

- The French Supreme Court confirms the importance of the French Financial Prosecutor’s Office in the fight against complex and international financial delinquency, Read analysis

- Transparency International sounds the alarm about the risks of corruption in the face of Covid-19, Read analysis

- French financial authorities warning on fraud increase in time of Covid-19, Read analysis

- French Prosecutor opened an investigation into potential mismanagement during the Covid-19 crisis, Read analysis

- The challenges brought to the independence of the French Public Prosecutor’s Office, Read analysis